Turn Your Home into a Retirement Fund

Unlock Your Financial Freedom

with a Reverse Mortgage

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Daniel Lotz

Daniel Lotz

What is a

reverse mortgage

A Reverse Mortgage is a safe and reliable financial tool that allows homeowners aged 62 and older to convert the equity in their home into tax free cash.

A reverse mortgage provides the

financial security you deserve.

Invest in

Travelling the

world

Enjoy a

comfortable

retirement

Secure your

Grandchildren’s

future

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Reverse Mortgages

Safe, Secure and Designed Specifically For You

Federally Regulated and Safe for Seniors

- Eligibility: Age 55+

- Loan tailored to your circumstances

Guaranteed Access to Your Money

- Use your funds freely

- Non-taxable cash

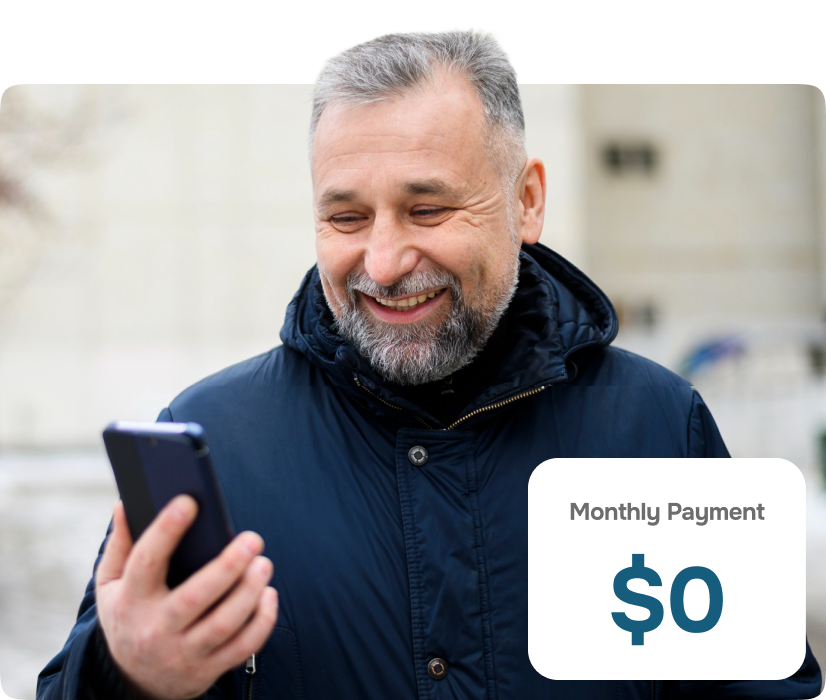

No Monthly Mortgage Payments

- Lifetime guarantee: No payments required,

- no matter the economy or how long you live.

Heirs Can Still Inherit

- Your heirs have 12 months to settle

- your estate and receive an inheritance.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

How Does It Work?

Eligibility

To qualify for a reverse mortgage, you must be at least 62 years old (55 in some states) with at least 50% home equity.

Flexible Payout Options

Line of Credit: Access funds as needed.

Lump Sum: A one-time lump sum payment.

Monthly Payments: Get regular payments

No Income Requirements

Unlike traditional loans, a reverse mortgage doesn’t hinge on your credit score or income. It’s about unlocking the value you’ve already built.

Repayment

The loan becomes due when you sell the home, move out, or pass away. Your heirs can can repay or sell the house to settle the debt.

Stay in Your Home

You can continue living in your home as long as you meet basic requirements (e.g., maintaining the property and paying property taxes).

No Monthly Payments

With a reverse mortgage, you won’t have to make monthly payments. Instead, the loan balance accumulates over time.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

How are reverse mortgages different today?

Today’s Reverse Mortgages are highly regulated by State and Federal laws to make them safe and to protect you. Among others, the following regulations apply.

- You retain title of the home.

- Fees and costs are federally regulate.

- No equity share is allowed, meaning the lender does not slowly take over your home.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Reverse Mortgage loan types

Home Equity Conversion

Mortgages

-

Safe and government regulated

Reverse Mortgage. - Never expiring, growing lines of credit, monthly income for life, cash up front.

-

You will never be required to make

a mortgage payment. -

Be owner of your

own home.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

HomeSafe Reverse Mortgages

Jumbo Reverse Mortgages

-

Utilized by owners of homes whose high

values make the HECM loan more limiting. -

You have guaranteed access to

your money.

-

Often referred to as Jumbo

Reverse Mortgages. -

Be owner of your

own home

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Hybrid Reverse

Mortgages

-

Utilized by owners of homes whose high

values make the HECM loan more limiting. -

You have guaranteed access to

your money.

-

Often referred to as Jumbo

Reverse Mortgages. -

Be owner of your

own home.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Reverse Purchase

Loans

-

Utilized by owners of homes whose high

values make the HECM loan more limiting. -

You have guaranteed access to

your money.

-

Often referred to as Jumbo

Reverse Mortgages. -

Be owner of your

own home.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Reverse Second

Mortgages

-

Utilized by owners of homes whose high

values make the HECM loan more limiting. -

You have guaranteed access to

your money.

-

Often referred to as Jumbo

Reverse Mortgages. -

Be owner of your

own home.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Compare your home equity options

Every retirement is unique, the financial tools that support them should be too. Let’s compare a

Reverse Mortgage and a home equity line of credit (HELOC) to see which option is right for you.

Reserve Mortgage

HELOC

Minimum credit

score required

No (financial assessment required)

Yes - minimum 680 credit score required

Monthly mortgage

payment required

No - if loan requirements are met

Yes-for 30 years, interest-only for 10 years,

then fully amortizing over 20 years

Minimum age

Yes-55, 60, or 62 depending on your state

No

Proceeds distribution

method

Lump sum, line of credit, scheduled payments,

or a combination

Line of credit, which can be drawn within

the first 10 years

Borrower still

owns the home

Yes

Yes

Unused line of credit

grows over time

Yes

No

Compare your home equity options

Every retirement is unique, the financial tools that support them should be too. Let’s compare a

Reverse Mortgage and a home equity line of credit (HELOC) to see which option is right for you.

Reserve Mortgage

HELOC

Minimum credit

score required

No (financial assessment required)

Yes - minimum 680 credit score required

Monthly mortgage

payment required

No - if loan requirements are met

Yes-for 30 years, interest-only for 10 years,

then fully amortizing over 20 years

Minimum age

Yes-55, 60, or 62 depending on your state

No

Proceeds distribution

method

Lump sum, line of credit, scheduled payments,

or a combination

Line of credit, which can be drawn within

the first 10 years

Borrower still

owns the home

Yes

Yes

Unused line of credit

grows over time

Yes

No

What’s in it

for you?

Financial Flexibility

Use the funds for home improvements, medical expenses, travel, or any other purpose.

Peace of Mind

Proceeds can be used at the discretion of the borrower to supplement their retirement income.

Security

You don’t need to sell your home to access funds.

Retire With Confidence

Retirement planning can be daunting. Many individuals worry about having enough savings to maintain their lifestyle without working indefinitely. The fear of outliving their nest egg keeps them up at night. But what if I told you that your home equity could be the key to a more secure retirement?

Leverage Your Home Equity

Most retirees have substantial equity tied up in their homes. This equity represents the value of the property they’ve built over the years. Instead of letting it sit idle, a reverse mortgage allows homeowners aged 62 and older to tap into this wealth.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Why People 55+ Love This Mortgage Product

01

Financial

Stress Relief

Not Enough Savings

The common thought is that other seniors have plenty saved up – the reality is the majority of many baby boomers and seniors find themselves in a challenging situation. Despite years of hard work, they haven’t saved enough for retirement. The fear of outliving their savings keeps them up at night.

The Solution

Enter the reverse mortgage. It’s like a financial safety net. By leveraging their home equity, seniors can reduce the pressure to save aggressively. Instead of relying solely on their limited savings, they can tap into their home’s value to cover living expenses, healthcare costs, and more.

02

Retire Earlier, Enjoy

More Freedom

Accumulated Home Equity

Most seniors have diligently paid off their mortgages over the years. Their homes have become valuable assets. With a reverse mortgage, they can unlock this equity without selling or moving out.

The Benefits

Retire Sooner:

Imagine retiring earlier than expected.

Financial Freedom

seniors can use the funds to enhance their lifestyle.

03

Risk Free

Solution

Peace of Mind

Seniors worry about financial risks. But here’s the beauty of a reverse mortgage: It’s effectively risk-free.

The Benefits

No Repayment Pressure

Unlike traditional loans, there’s no rush to repay.

Stay in Their Home

Seniors can continue living in their beloved home.

The Reverse One Team is dedicated to one thing: You

We specialize in Reverse Mortgages, ensuring you have the smoothest experience possible. Each team member has a unique role, allowing us to focus on our individual expertise and create a process that moves seamlessly from milestone to milestone.

- Or feel free to give us a call now at

- +1 949-919-6105

- to learn more

Reverse mortgage wins

Jenny and Tom

We removed the worry of having to sell our forever home.

Muhammad

I added an additional “tax-free” monthly income source.

Suzanne

I retired early, allowing for more time spent with family.

Bennet

I eliminated my mortgage payment, all credit card debts, and provided a line of credit to draw from in case of emergencies.

2160 Superior Avenue, Cleveland, OH 44114

NMLS3029 | MB.803095AZ

* Disclaimer: Eligibility for homeowners age 55+ applies to most states, but not all. The age requirement to be eligible for a Reverse Mortgage is state specific. Please speak to our Reverse Mortgage Specialist to learn the age requirement for your state.

THIS SITE IS NOT AUTHORIZED BY THE NEW YORK STATE DEPARTMENT OF FINANCIAL SERVICES. PHONE NUMBERS DISPLAYED ARE NOT FOR USE BY NEW YORK BORROWERS. NO MORTGAGE SOLICITATION ACTIVITY OR LOAN APPLICATIONS FOR PROPERTIES LOCATED IN THE STATE OF NEW YORK CAN BE ACCEPTED THROUGH THIS SITE.